What is Whole Of Life Insurance in Ireland? Everything You Need To Know

There are different types of whole-of-life insurance plans in the market. It is sometimes called over-50s cover or funeral cover but the terms are interchangeable. In this article, I am going to explain what they are and how to get the best value. There are two main types of whole-of-life cover. Reviewable (or what I like to call avoidable) and guaranteed whole of life.

The whole of life cover is different from term assurance as it will last until the day you die. On the other hand term assurance is set for a fixed number of years. Term assurance is more suited to people with young families. This is because they might need a lot of coverage and they might have a small budget. However, If you are looking for a guaranteed payout then Guaranteed whole of life is the plan for you.

For example, if you are in your 50s and you want funeral cover then taking out a plan for ten years doesn’t make sense. This is because you will need to renew ten years from now. At that point, the price will have jumped. Obviously, if you died within ten years then it would be great value. But with people living longer now than ever before a whole-of-life plan should ideally be used for funeral cover.

You may also like to read:

- 1. Life Insurance Terminology Explained

- 2. Life Insurance After Cancer in Ireland

- 3. Life Insurance and Multiple Sclerosis (MS)

Reviewable whole of life versus Guaranteed whole of life

There are some companies out there that offer reviewable whole-of-life cover. The main providers don’t offer these anymore but some existing customers often still have them as they may have taken them out 20 years ago.

Most of the time people take them out young. The premiums seem small but what people don’t realize is that come to the review stage the premiums will jump significantly. Eventually, they get so big that the customer can no longer afford the plan and they end up canceling and with nothing after paying their premiums for years and years. The reason for the jump in cost is the hidden charges associated with these plans.

They often have a fund value which basically means that part of the premium in the early days went into a fund to cover the cost of the customer as they get older. This actually hides the cost of the true premium.

Reviewable whole-of-life example

For example, Mary may have been paying €50 quid for five years. At the beginning of the five-year period, she may have had a fund value of €2000. After 5 years when she goes to renew the premium has jumped to €150. The reason for this is that Mary’s fund is now at zero. For the last five years while she thought she was paying €50 the true cost of her plan was actually €83 but the extra €33 was coming from her fund value.

Mary now has a significant jump in costs on her plan if she wishes to keep it going and Mary now knows that in another five years, her costs will go up again.

Hence the reason I like to call this avoidable whole of life. Avoid it if you can.

Guaranteed whole of life on the other hand you know what you are getting from day 1. You can have it increase in line with inflation but this is an option you can turn off. For example, you can choose to have it increase by 3% per annum. If you do so the costs generally go up by 4.5% per annum.

But you can switch this option off. Generally speaking guaranteed whole of life will give you a guaranteed benefit that will not change(if you opt for no indexation) at a fixed price for life.

What about Section 72?

The guaranteed whole of life insurance plans are perfect for inheritance tax planning and Estate planning.

They are the ideal plan for covering potential inheritance tax issues. The reason they are ideal is that they are guaranteed to payout and you can easily make them a section 72 plan. Section 72 is a life insurance plan that is designated to pay for inheritance tax and it does not form part of your estate.

If you do not turn a life insurance plan into a section 72 it will form part of your estate.

Why is this important? Take Frank. He has total assets of €2m. He is widowed and has two children Jack and Mary. On Franks’s death, Jack and Mary are to inherit €1m each. However, they are liable to inheritance tax on any proceeds above €335,000 at a rate of 33%.

That’s a whopping €219450 each that Jack and Mary will have to pay in tax.

The solution is simple a guaranteed whole of life plan of €438900. Arranged as a section 72 this will cover all tax costs.

If it is not arranged as a section 72 poor Jack and Mary would have to pay €291868.50 in tax, so make sure to have a financial advisor that knows how to set up the plan as a section 72.

Read more about:

- 1. Getting Life Insurance with Diabetes

- 2. Tax Savings – The Ultimate Guide for the Self Employed

- 3. Which Life Insurance is Best?

The whole of life and Section 72 Case study

John and Patricia are both 55 they have total assets of €2m and two children to leave the money behind too. They are planning on leaving their children the estate after they have both died. They do not want their children to be hit with a tax liability of €219,450 each.

The solution is a joint life second death guaranteed whole of life insurance plan. The premium is €572.69 per month. If they live to age 100 they will not have to pay anymore (one of Royal London’s whole of life plan benefits).

This means that they will have to pay €6872.28 per annum. This means it would take them 63.87 years if they set aside €572.69 per month in an effort to accumulate €438900. And if they did that they would simply be adding to the tax liability of their children. This case study shows the value of a guaranteed whole of life plan. It is guaranteed to save the family money.

The whole of life with life changes options

In terms of the best whole of life insurance plan on the market, I am a big fan of Royal London’s guaranteed whole of life with life changes options.

This plan will let give you three options after you have paid for 15 full years.

- 1. End your plan and get back up to 70% of the money you have paid in.

- 2. Stop paying and reduce your cover down to a lower level

- 3. Keep going as you were with no changes.

Each year the benefits of the options get better and better.

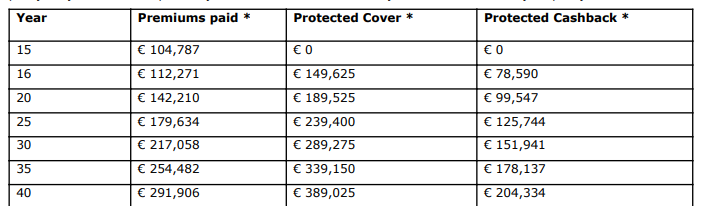

The table below is Royal London’s joint life second death plan for cover of €438,900. As you can see it provides options after paying for a full 15 years. At the start of year 16 the couple will have spent €112,271 in premiums. If they feel they no longer can afford the plan they can stop paying and reduce the cover to €149,625 or get a refund of €78,590 or just keep going as they were.

If they did stop and take the reduced cover benefit at least they know they will have spent less in premiums and their plan is guaranteed to make them a profit.

The whole of life with options Table 1:

To conclude, if you are looking to leave money behind to someone or you wish to provide for your own funeral or cover inheritance taxes then whole of life insurance is the best possible plan to do so. Unlike term assurance, it does not have an end date( the best term cover can be extended as far as age 91 In the market) and as such it provides certainty that your wishes will be fulfilled.

At Financial Life we deal with all the major providers and have access to the best whole of life plans in the market.

If you have any questions in relation to this you can reach me on 015823524 or email me at sean@financiallife.ie

Disclaimer: The information provided in this blog post is for informational purposes only and should not be considered professional advice. It is advisable to seek expert financial advice for personalized guidance regarding life insurance.

YOU MAY ALSO BE INTERESTED IN:

1. Life Insurance Terminology Explained

2. Getting Life Insurance with Multiple Sclerosis (MS)

3. Getting Life Insurance with Diabetes

Insurance

Insurance  Insurance

Insurance  Insurance

Insurance  Insurance

Insurance