Tax Savings- The ultimate Guide for the self Employed

This article is for those who want to save for their future and at the same time pay less tax. So if you want to pay more tax and don’t care about the future then this article is not for you. I will explain how to get the best from your hard-earned cash. Make your money work for you and take advantage of the tax savings benefits available to you. I will also discuss what to look out for in charges to help you get the best deal.

Calculate your Tax liability

Firstly, consider this: If you are self-employed you must calculate your tax liability and make a payment by 31st October 2021(17th November 2021 for ROS) in respect of your:

- Final Tax Assessment for 2020 and

- Preliminary tax for 2021

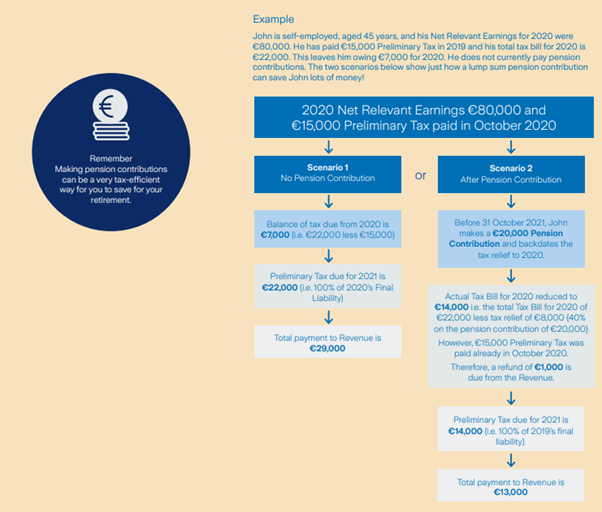

In the example above we have John earning €80,000 per annum. John owes tax of €22,000 for 2020. He has paid €15,000 in preliminary tax in 2019 which means he owes a further €7000 to the tax man for this year. He then has to pay preliminary tax of €22,000 for next year. It costs him €29,000 in total and he has nothing sitting in the coffers for when he retires.

Alternatively, John could make a pension contribution of €20,000. As he is a higher rate tax payor the revenue will give tax relief of €8000 which he can backdate to last year. This means instead of having a 2020 liability of €22,000(of which he has already paid €15,000) his liability is now only €14,000. This means revenue actually owe him €1000.

Additionally as his 2020 liability has become €14,000 his preliminary tax for 2021 is now €14,000 and not €22,000 as before. So, John is only hit for a €13,000 tax liability as the revenue owed him €1000.

And the great thing is he has €20,000 sitting in his pension.

So John’s options are to pay €29,000 and get nothing for it or pay a total of €33,000 and have €20,000 of a pension to show for it. It doesn’t seem like a tough decision!

So John’s options are to pay €29,000 and get nothing for it or pay a total of €33,000 and have €20,000 of a pension to show for it. It doesn’t seem like a tough decision!

| Scenario 1 | Scenario 2 | |

| Tax | €29,000 | €13,000 |

| Pension for retirement | €0 | €20,000 |

| Tax Savings | €0 | €16,000 |

So how do pensions work?:

Pensions are like savings plans on steroids. You get tax relief on your contributions at your higher rate of tax. So, if you pay 20% tax you will get 20% back off the revenue and if you pay 40% tax you get 40% back off the revenue. To simplify, if you pay €100 it only costs you €60 and the full €100 is invested in the pension.

The pension funds are then invested in funds linked to stocks/shares/bonds etc. What you choose to invest in will depend on your attitude to risk. Generally speaking the more risk you take will lead to better returns over time but obviously you need to consider your age and when you intend to take the benefits as if you are invested in a high risk fund and you want to retire soon if a recession hits that could impact your pension pot. The earlier you start your pension the better but as the tax relief shows it is never too late to start. This is because you get instant returns via the tax savings.

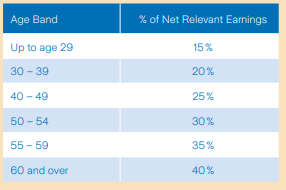

How much you can put in depends on your age and your income if you are self-employed or an employee.

So, for example, if you earn €100,000 per annum and are aged 60 the most you can contribute is €40,000 per annum. The maximum income for tax savings purposes you can use is €115,000. So for instance, if you earn €130,000 and are 60 the most you can contribute is €46,000 per annum which would save you €18,400 in tax.

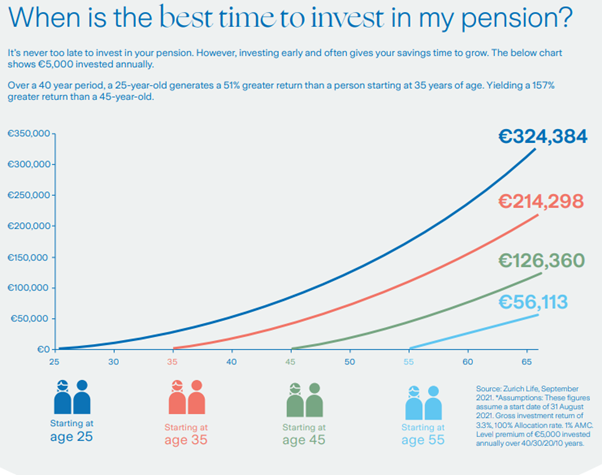

The benefit of starting early is because you get the benefit of compounding interest. With pensions your funds grow tax free so essentially you make interest on top of interest.

As can be seen by the picture above investing €5000 per annum aged 25 will lead to a far bigger pension pot than someone who only starts investing aged 55. This is not only due to the increased amount of contributions but it is also down to the effect of compounding interest.

Now I know how pensions work which one is best for me?

For the self-employed there are two options:

- Personal Pensions

- PRSAs

For both, the tax savings available are exactly the same. Personal Pensions allow a wider array of fund choices, but they can have more charges. Essentially the charges will be down to who you seek your financial advice from. The charges don’t necessarily have to be higher. There is a vast array of charging structures.

Generally speaking, there are various charges on the market including allocation rates, policy fees annual fund charge, renewal, trailer fees and surrender penalties.

PRSAs have restrictions on charges (they don’t have policy fees or surrender penalties) but they also can have restrictions to fund choices. Speak to your financial planner to find out which suits you the best. Often the allocation rate for PRSAs might be lower than personal pension. E.g. for a PRSA the allocation rate might be 95% which means if you pay €100 into your pension only €95 actually gets invested.

Personally, I like personal pensions for the self-employed as you get full access to the different fund options available and there are options to keep charges low. Sometimes for higher contributions policy fees can be waived and if you don’t move your pension for five years surrender penalties will not apply. Different life insurance companies have different fee structures. The important thing to do is speak to your advisor about the different charges in order to get the best deal. Generally it is the annual management charge that has the biggest impact on charges so keeping this down will have the biggest impact on charges.

What will I get at the end?

With personal pensions and PRSAs you can mature the benefits from aged 60. In some circumstances if it is an employee PRSA (set up by the employer) you can cash in aged 50. Your pension pot will be based on how much you put in and the investment gains you made. The overall pot will then be split. You get a 25% tax free lump sum with the remainder going to an Approved Minimum Retirement fund (AMRF) or an Approved Retirement fund(ARF). A(M)RFs as they are known are essentially your pension that you can draw down on. There are different rules for AMRFs and ARFs. Essentially, once you have an income of €12,700 or start receiving the state pension the AMRF turns into the ARF. With the ARF you can take as much as you like out of it. AMRFs are generally restricted to 4% per annum drawdown.

How do I set one up?

It is very easy to set up a pension and get instant returns via tax savings. It’s a simple form with basic information that you need to sign. Your advisor should go through a factfind and risk profile analysis with you to see which funds suit you the best. You could say to your advisor the level of income you want to have in retirement and he can calculate the amount you need to save to achieve that goal. Essentially, you can decide to contribute as much as you like subject to the limits mentioned above. If you would like to speak to me about any questions you may have in this article or if you would like help setting up your pension you can call me on 015823524 or email me at sean@financiallife.ie and I would be happy to help.

Insurance

Insurance  Insurance

Insurance  Insurance

Insurance  Insurance

Insurance