What does income protection cover and why do I need it?

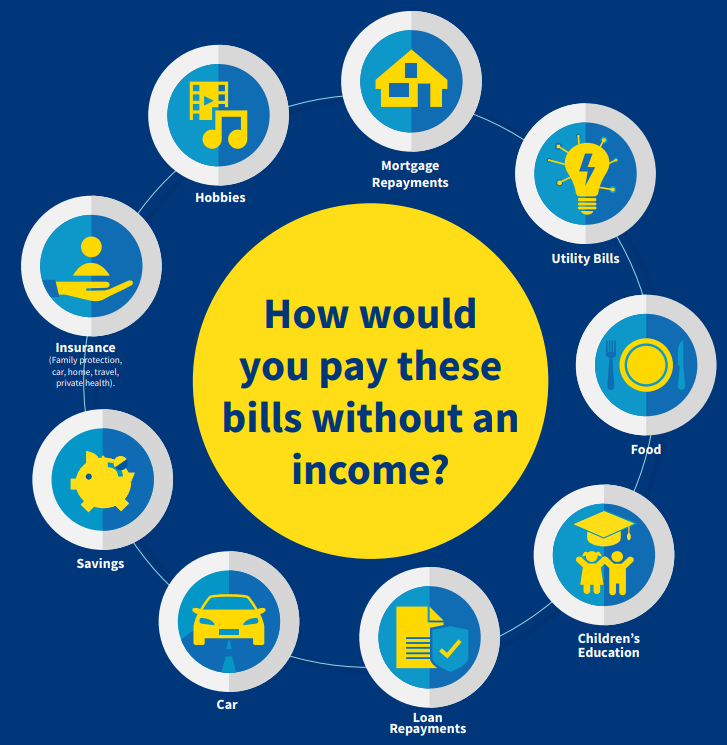

In this article we will look at the importance of income protection, what it covers, and why you should have it. Firstly, do you enjoy your current lifestyle? Perhaps not so much during lockdown where a trip to Lidl is the highlight of the week. But generally speaking, do you enjoy going to the movies or the occasional night out with drinks and food in a cozy little restaurant? Or perhaps more importantly do you enjoy not having to worry about paying your mortgage and putting food on the table for your kids? If the answer to these questions is yes then have you ever given it some thought as to what would happen if you were one of the unlucky ones who didn’t go through life plain sailing? What if you got an illness or were out of work for a sustained period of time and your income dried up? What would you stop paying for first? The cinema, the drinks, food for your kids, your mortgage, your electricity, your tv, etc…

some stats:

According to the Marie Keating foundation1 in 2 people will develop cancer in their lifetime in Ireland. You might think to yourself, ah sure it won’t happen to me but the average claimant for Income protection in Aviva in 2019 was only 46 years of age.

At present social welfare will pay you €208.5 per week if you can’t work due to illness. This is €10,842 per year. So imagine if you got were the 1 in 2 who got cancer and were out of work for a sustained period of time your income would drop to €10,842 per annum and that’s only if your employed.

Interestingly Aviva’s 2019 claim stats were as follows:

- 31% were Orthopaedic

- 24% of claims were Psychological

- 16% of claims were cancer-related.

- 7% Neurological

- 3% Cardiac

- 2% Respitary

- 17% Other medical condition

The stat’s show how comprehensive the cover is with income protection where people can claim as a result of a bad back, stress, or cancer. Essentially if your doctor says you can’t work for any reason you are covered.

The solution is simple. Protect your most valuable asset which is your income with income protection ideally and if you can’t afford income protection there are other alternatives such as specified serious illness cover.

For most income protection is very affordable given that the government will chip in for you and give you up to 40% off depending on your income. Effectively for most, if you are earning over €35,300 you will get 40% off your premiums in tax relief.

So how does income protection work?

There are rules around how much you can insure yourself for. Essentially it is 75% of your income less social welfare benefits ( for self-employed not entitled to the short-term illness benefit), so generally speaking, for the employed you can include social welfare benefits but for self-employed best not to.

So if you earned €40,000 and were an employed person you can insure up to €19,118 knowing that the state will give you €10,882 which will give you a total out-of-work income of €30,000. If you are self-employed you can insure the full 75% of €40,000 which is €30,000.

You need to also consider employer pay because if your employer is paying you an income while you are off you do not want your total income to go over the 75% threshold above, as you will not get paid more than 75% of your income inclusive of your income protection plan, state contribution and employer contribution.

Then you need to consider when the benefit is to kick in. With income protection, you can have it paid to you after being out of work for 4 weeks, 8 weeks, 13 weeks, 26 weeks, or even a year. The longer your benefit kicks in (called your deferred period) the cheaper your plan will be. If your employer is paying you for six months then it makes sense to have your income protection kick in after 6 months. If you have a reasonable amount of savings then you can use this as a buffer too to enable you to have a longer deferred period.

Tip: Keep it till you retire

With most of us retiring at aged 68 nowadays due to the ongoing pension crisis and the inability of the government to continue paying our pensioners the state pension you should consider taking out your income protection to age 68. However, if you plan on retiring earlier on a private pension then you can match this age on your income protection plan, and that way you are fully covered until you retire.

You cannot have income protection in retirement as you must be working to avail of it. If you do choose an earlier retirement age than 68 your plan will be cheaper but be wary of doing this because the older you are the more likely you are to become ill.

So is income protection the same price for everyone?

The answer to this is no. I often get people saying their friend pays less but this is likely because their friend is younger or a non-smoker or their job is admin and sitting on their chair all day. Income protection will be priced based on your age, your smoker status, the level of coverage you are taking out, your deferred period, and your occupational class. Occupational class breaks people into four categories.

Category 1 is sitting behind a desk all day. If you’re doing admin your chance of doing your back in is probably limited to picking up the spuds at the supermarket every week while if you’re a builder and your lifting heavy material all day you would be a class 4 as you’re more likely to hurt your back. For occupations of class 4 (whose income protection premiums might be too high or those who can’t get income protection as a result of their occupation being considered too risky (for example a binman) there are alternatives such as serious illness cover and serious illness cover is not occupationally rated.

To conclude you can see why income protection is so important It protects your family from facing uncertain times if the worst happens and helps you to concentrate on getting better if you got something like cancer which can be life-changing.

For those who do get sick and don’t have income protection the biggest worry can be paying the bills, never mind their illness. If you have any questions about income protection feel free to email me at sean@financiallife.ie or call me at 015823524 or get yourself a quote don’t forget to take 40% off the quote if you are a higher rate tax payor and 20% if you are a lower rate tax payor.

Insurance

Insurance  Insurance

Insurance  Insurance

Insurance  Insurance

Insurance