The best Income replacement plans

If you are looking for the best income replacement plans on the market then this article will give you the information that you need. There are lots of different income replacement plans on the market designed to help you protect your income should you be unable to work due to illness or an accident or even stress. This article will discuss the merits of each plan on the market today and it will discuss their value for money too.

So what type of cover is available?

There are loads of different types of income replacement on the market. The best income replacement plans are:

- Income Protection

- Specified Serious Illness cover

- Multi Claim cover

- Personal Accident Cover

Income Protection

If you are looking for comprehensive cover then it is hard to argue against income protection. It provides cover for anything from a serious illness to stress to a bad accident. Basically, if your doctor says you are unable to work you are covered by income protection. You set it up normally until retirement and your plan kicks in after a deferred period. So for example, if you have a deferred period of six months your plan will kick in after you have been out of work for six months. This might seem like a long time but if you had a serious illness such as cancer or even suffered from depression, which can be very common for women after giving birth, you could be out of work for a very long time. When you make a claim your plan will continue to pay you a monthly wage until you go back to work or until your retirement age. Whatever is the earliest. The price of income protection will depend on your occupation along with factors such as your age, health, smoker status and the amount of cover you are looking to protect. Higher risk jobs such as a builder will pay more than someone in admin. Occupations are broken down into four categories with admin in category 1 and a builder in category 4. For those in categories 3 & 4 it is worth looking at Aviva’s wage protector which is cheaper than traditional income protection. It is exactly the same product but will only pay you for two years. It will only pay you for more than two years if you are severely disabled and unable to work. The best thing about income protection though is the government will chip in for you based on whether you are a higher rate or lower rate tax payor. So if you are a higher rate tax payor a plan that is €100 will only cost you €60. If you are a lower tax payor a plan that might cost €100 is €80.

Main pros:

- Most complete cover in the market

- Tax relief which means the government chip in

Main Cons:

- Can be expensive if you are in a high-risk category such as a builder

- Not everyone can get it as it can be heavily underwritten

- Kids are not covered

Specified Serious Illness Cover

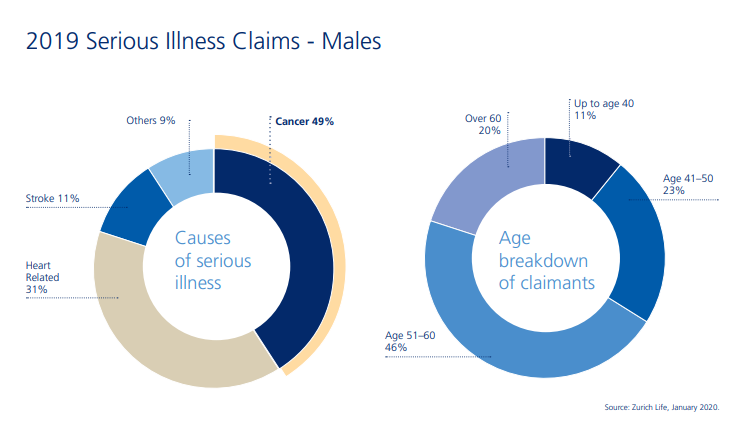

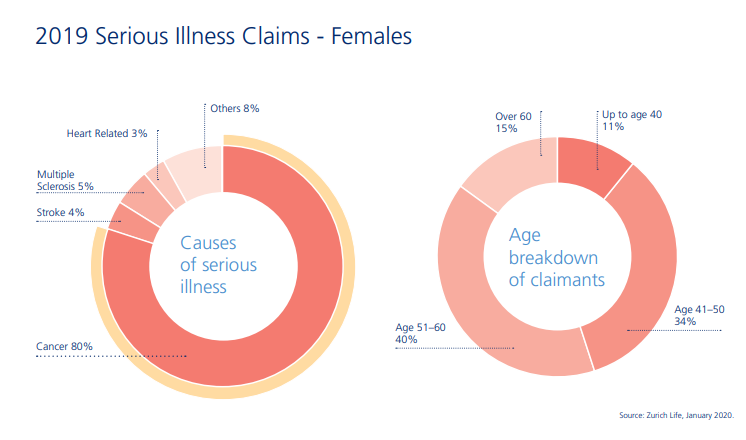

Specified Serious illness cover protects you by giving you a lump sum if you are diagnosed with one of the listed specified serious illnesses. Your illness needs to match the definition of the life insurance companies definition of the illness in order to make a claim. For this reason, it is not as comprehensive as income protection cover. All of the life insurance companies cover a wide range of illnesses from cancer, heart attack and stroke which make up the majority of claims to some obscure illnesses such as Myasthenia gravis. I’m guessing 95% of people reading this article haven’t a clue what Myasthenia gravis even is. Either did I. I googled it and it’s fairly nasty. Myasthenia gravis is a long-term neuromuscular disease that causes different levels of skeletal muscle weakness. It often affects muscles in the eyes the face and those involved in swallowing. You can have symptoms such as double vision, problems speaking and walking. Only New Ireland currently cover this illness but it is fairly rare and unlikely you would ever need it. If you look at the statistics below from Zurich you can see Male claims and female claims differ. Men have more heart related claims than women but women suffer more from cancer. Overall at Zurich cancer accounts for 65% of all serious illness claims.

In truth the most important decision about which serious illness plan you take should come down to which company has the best definitions of each illness rather than the number of illnesses covered

Zurich define cancer as “Any malignant tumour positively diagnosed with histological confirmation and characterised by the uncontrolled growth of malignant cells and invasion of tissue. The term malignant tumour includes leukaemia, sarcoma and lymphoma except cutaneous lymphoma (lymphoma confined to the skin). For the above definition, the following are not covered: All cancers which are histologically classified as any of the following: pre-malignant; non-invasive; cancer in situ; having either borderline malignancy; or having low malignant potential”

On the other hand, New Ireland define it as “Any malignant tumour positively diagnosed with histological confirmation and characterised by the uncontrolled growth of malignant cells and invasion of tissue. The term malignant tumour includes leukaemia, sarcoma and lymphoma except cutaneous lymphoma (lymphoma confined to the skin). For the above definition, the following are not covered: All cancers which are histologically classified as any of the following: pre-malignant; non-invasive; cancer in situ; having either borderline malignancy; or having low malignant potential; All tumours of the prostate unless histologically classified as having a Gleason score of 7 or above or having progressed to at least clinical TNM classification T2bN0M0; Chronic lymphocytic leukaemia unless histologically classified as having progressed to at least Binet Stage A; Malignant melanoma unless it has been histologically classified as having caused invasion beyond the epidermis (outer layer of skin); Any other skin cancer (including cutaneous lymphoma) unless it has been histologically classified as having caused invasion in the lymph glands or spread to distant organs; Any urinary bladder cancer unless histologically classified as having progressed to at least TNM classification T2N0M0. All thyroid tumours unless histologically classified as having progressed to at least TNM classification T2N0M0.”

Based on those definitions in my opinion Zurich’s cancer definition is the best in the market which is important considering cancer makes up such a large portion of claims under a specified serious illness contract.

The good news is that even if you got a less serious version of cancer you may be covered under a partial claim for cancer in situ which is basically cancer that has not spread to another part. Most of the insurance companies will pay you up to half of your total cover for something like this(subject to a maximum of €15,000 or €20,000 with Aviva) and most of them will not deduct this claim from your main benefit.

Serious illness is a great benefit to add on to a life insurance plan as not only does it protect you but it also covers your kids for half of your amount up to a maximum of €25,000 and the kids are all covered for free.

Main Pros:

- Will pay you a lump sum which will help you take time out of work if you get a serious illness.

- The kids are covered for free up to a maximum of €25,000.

- Your occupation doesn’t matter so a builder will pay the same as someone in admin.

- There are lots of partial payments which will not affect your main benefit.

- Can arrange life cover on the plan too for very little cost when it’s added to the plan and the serious illness benefit is included as accelerated.

- Can combine with personal accident cover to have more comprehensive cover

Main Cons:

- It does not have tax relief

- It only covers specified serious illnesses so the serious illness you get must be on the list and meet the definition of the illness in order to make a claim.

Multi Claim cover

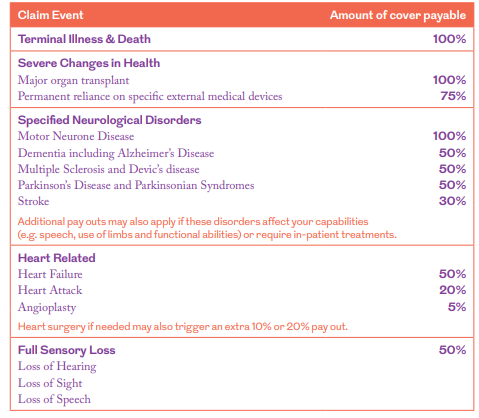

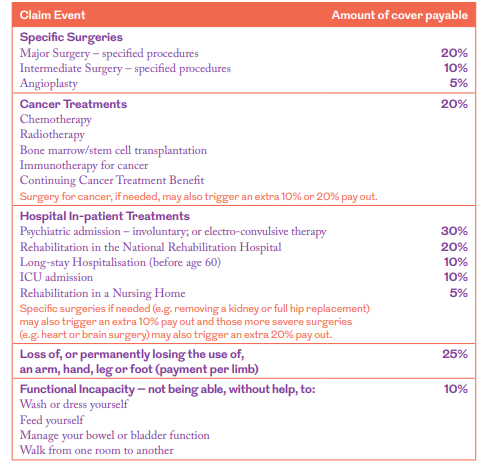

This is a unique offering from Royal London. It is a bit like Specified Serious illness cover only instead of paying you with one huge lump sum it will pay you smaller lump sums as and when you need them. You insure yourself for a specific amount for example €100,000 and this is your total pot. If you make a claim you are paid a portion of your pot based on how serious your condition is. The policy will pay out between 5-100% of the cover depending on what your illness or condition is. It is more affordable than serious illness cover. It works as follows, if you had €100,000 cover and suffered a heart attack €20,000 of your cover would be paid out with €80,000 remaining. If you had an angioplasty (likely to happen after a heart attack) another €5000 would be paid out reducing your cover to €75,000. If you were in ICU as a result of the heart attack for 48 hours you get paid a further €10,000. If you are on hour 47 just be nice to your Doctor and ask for a further hour in ICU!

What I like the most about multi claim cover is that it is more accessible to those with underlying illnesses, so it is easier to get than income protection and serious illness cover If you suffer with diabetes Multi claim cover is likely the best cover available to you in the market to protect your income. It is likley there would be certain exclusions but you could get cover for the majority of conditions. People who have been denied income protection or serious illness cover due to an illness can potentially protect their income with this plan.

Main Pros

- Life cover included on the plan.

- Easier underwriting allowing people with diabetes and other illnesses the ability to protect their income

- Can be cheaper than serious illness cover (check with a broker as this is not always the case)

- You are covered for multiple events and can be covered for certain events that would not be covered under a serious illness plan such as ICU admission

- Free Children’s cover

Main Cons

- No tax relief

- Like Specified Serious illness cover a claim needs to meet the definition.

Personal Accident cover

Personal Accident is a type of income replacement that pays you a weekly benefit if you have been unable to work for a period of two weeks as a result of an accident. It pays for up to 52 weeks. This is a great benefit to have if you can not afford income protection cover but feel you may be at risk in work if your job is physical or if you play sports. It is inexpensive and can be added to a plan with serious illness cover to have more comprehensive cover. You can cover up to €400 per week to a maximum of half of your weekly earnings.

Main pros:

- Its inexpensive

- Easy to get

Main Cons:

- Only covers you for 52 weeks

- Not very comprehensive as it only covers you for accidents

- No tax relief

So what should I have?

To find out what type of income replacement suits you the best it is important to speak to your financial advisor. For arguments sake let’s assume you have a 45 year old nonsmoking nurse on €45,000 per annum retiring aged 65. Lets assume she takes an income protection plan with a deferred period of 6 months. She is looking to protect herself for €23,194 (this is the most she can do as with income protection you can only insure 75% of your income less illness benefit). To have this plan will cost her €76.34 net.

If on the other she took out €90,000 (roughly two years’ salary which is average time it takes to go back to work after an illness) worth of life cover with accelerated specified serious illness cover the premium would be €69.77. While we are comparing apples with oranges here in this example the better value is with income protection in my opinion as it has a much higher potential payout considering if you made a claim you could be out of work for nearly 20 years while if you made a claim under serious illness cover you are only going to receive one lump sum of €90,000. Additionally under income protection the nurse could claim for an accident or depression or stress if applicable but these situations would not be covered under a serious illness plan.

If however, you were a builder in this same example your income protection would cost €105.19 net so income protection becomes a little less attractive.

In conclusion in my opinion the best income replacement plan is income protection. Income Protection is the best way to protect your income against illness or an accident. It is the most comprehensive plan on the market and is affordable for most thanks to tax relief. However, for those on a tight budget serious illness cover is an excellent way to have a little bit of cover if the worst happens and you can include life cover on the plan for very little cost. It is also covers your children so if the worst happened you could take a break from work to look after them. Whatever you decide to do having some form of income replacement cover is essential to protecting your family financially as if you become ill the bills still need to be paid. Make sure you focus on getting better rather than the worrying about how your bills are going to be paid.

If you have any questions at all about income replacement in this article feel free to contact me on 015823524 or email me at sean@financiallife.ie with any queries you may have. Please note this article is for information purposes only and is not to be taken as financial advice.

Insurance

Insurance  Insurance

Insurance  Insurance

Insurance  Insurance

Insurance