Income Protection for Medical Professionals in Ireland

As a medical professional in Ireland, your income is essential to your livelihood, it is the foundation of all your future hopes and dreams. However, an unexpected illness or injury could jeopardize your ability to work and earn a living and throw your future plans into chaos. That’s where income protection comes in.

Why You Need It

Afterall, we insure our homes, cars and most other things we consider valuable, so why not insure our Income??

Income protection provides financial security if you’re unable to work due to illness, injury, or disability. It can help you replace a portion of your income, so you can continue to meet your financial obligations and maintain your standard of living.

Ok, but do I really need Income Protection?

Let’s consider some statistics that emphasize the importance of income protection for medical professionals in Ireland:

According to the central statistics office( CSO) , As of end of 2022 there are 331,100 people working in the healthcare sector

The Medical Council of Ireland reports that as of 2021, there are over 21,000 registered doctors in the Ireland. The Nursing and Midwifery Board of Ireland (NMBI) notes over 80,000 nurses and midwives registered.

These statistics highlight the significant number of medical professionals who could benefit from income protection.

The risk of Illness or injury is REAL for the medical profession

Medical professionals are at an increased risk of becoming disabled due to the nature of their work. They are exposed to infectious diseases, hazardous materials, and physical injuries. As a result, they are more likely to experience long-term health problems that could prevent them from working.

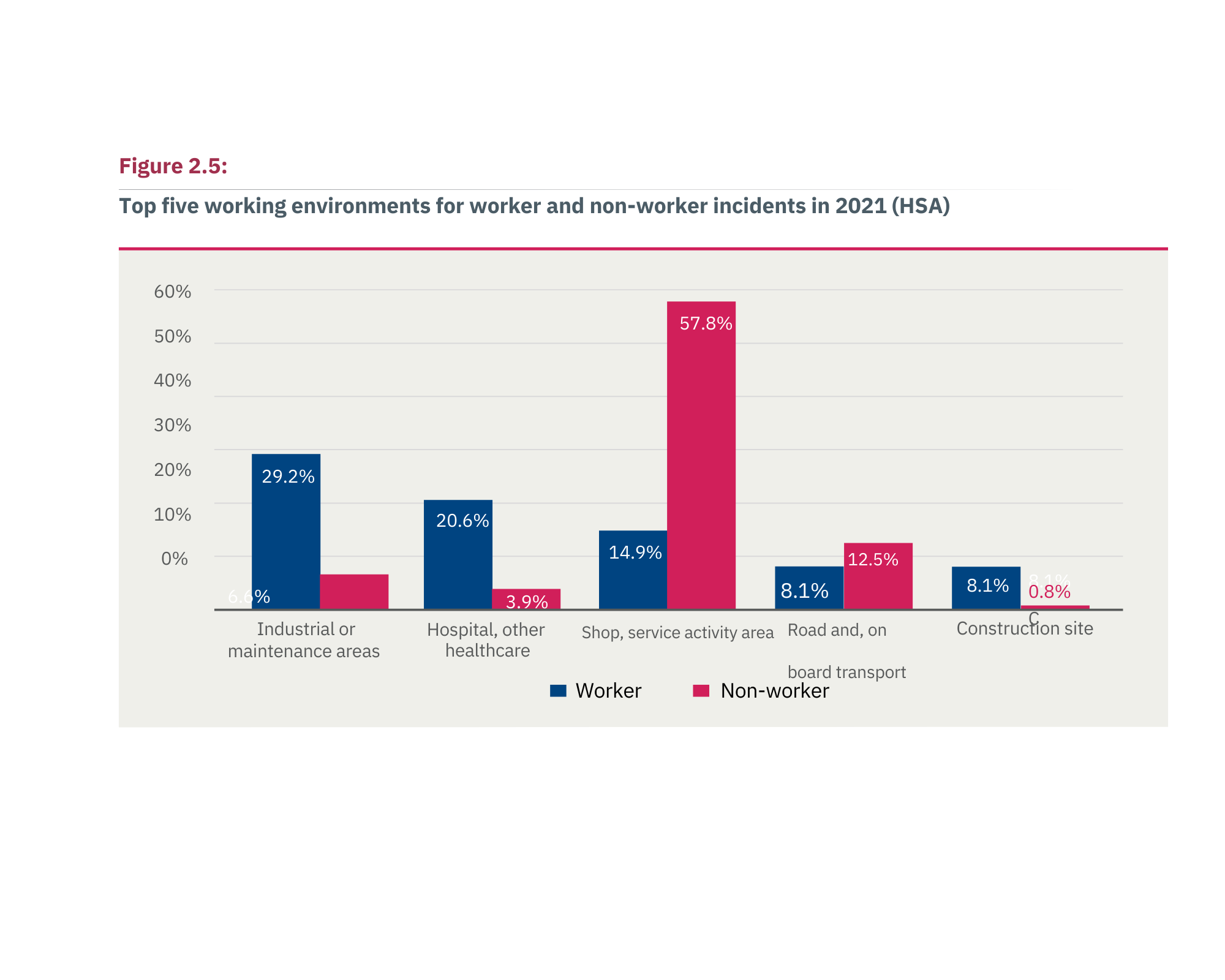

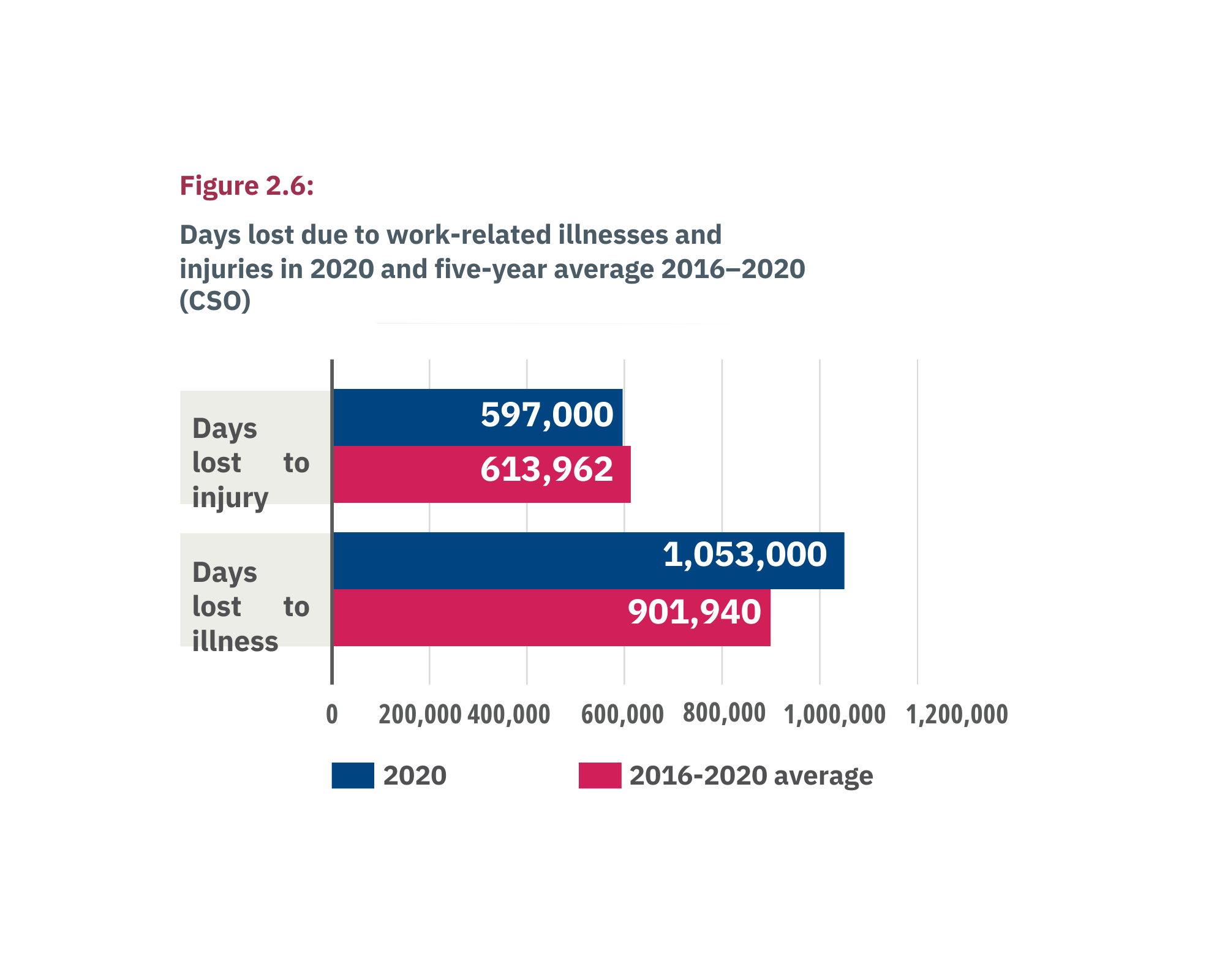

According to the Health and Safety Authority, the number of non-fatal incidents remain high in Ireland with 8,279 reported in 2021, of this 1,838 occurred in Human Health and Social Work Activities. The most common work-related illnesses are bone, joint or muscle problems followed by stress, depression or anxiety.

The Irish Heart Foundation reveals that heart failure, a chronic condition affecting 90,000 people living in Ireland and responsible for 20,000 hospital admissions each year. There are 10,000 new cases every year.

The word “CANCER” is probably one of the most feared words in existence. Most of us have been impacted by cancer either directly or indirectly, evidently this is not surprising considering that 1 in 2 people will get cancer in their life time. According to the Irish Cancer Society, cancer is a significant health issue, with over 44,000 new cases diagnosed each year. As of 2020 there were 207,000 cancer patients or former cancer patients alive in Ireland.

Why Medical Professionals Need Income Protection

Income protection for Medical Professionals in Ireland can provide a financial lifeline to medical professionals who are unable to work due to illness or injury. It can help them cover their living expenses, such as mortgage payments, car loans, and medical bills. It can also help them maintain their standard of living, so they can continue to provide for their families.

How Income Protection Works

Income protection policies typically pay out a monthly benefit of up to 75% of your pre-disability income. The amount of the benefit is determined by your age, occupation, and health history.

There is usually a waiting period before the benefit payments start. This waiting period is typically 4,8,13,26 or 52 weeks. You can decide the waiting period you wish to have based on your employer’s standard short term sick pay policy.

Income protection policies can be purchased for a variety of terms, such as 10, 15, or 20 years. Ideally you want your income protection plan to insure you up to your retirement age.

Taxed like normal earned income….

As a PAYE worker, the income protection benefit is typically paid as a replacement of your taxable salary. This means the benefit received is subject to income tax, similar to your regular salary.

Yes, you can claim Tax Relief on the cost of you Income Protection

If you’re a 40% taxpayer, you can claim 40% tax relief. For example if your income protection costs €100 per month, the real net to you will be €60 per month after tax relief.

How much of my income can I insure?

The maximum any Income Protection plan will pay you is up 75% of your gross salary, minus any illness benefits you receive from the state.

This can get confusing, so some examples may help…

Here are a couple of claim scenarios to demonstrate how income protection for medical professionals supports works in real life:

DR DR……

1.Dr. Murphy, a self-employed hospital consultant earning €100,000 per year, suffers a severe injury that renders her unable to work. She is not entitled to any state benefits. With her income protection policy, she qualifies for a monthly benefit of 75% of her pre-disability income, amounting to €6,250 per month. This steady income ensures Dr. Murphy can cover her living expenses and maintain herself financially while focusing on her recovery.

2.Dr. Ryan, a general practitioner earning €80,000 annually, is diagnosed with a chronic illness that requires him to take an extended leave of absence. Dr Ryan is entitled to €11,440 per annum of state illness benefit. Thanks to his income protection coverage, he receives a monthly benefit of 75% of his pre-disability income minus state benefits, totalling €4,046.67 per month (75% of €80,000=€60,000-€11,440= €48,560 per year or €4,046.67 per month.

This financial support allows Dr. Ryan to manage his ongoing expenses, including mortgage payments, utility bills, and medical costs, ensuring stability for himself and his family during this challenging period.

Sarah is a Nurse

3.Sarah, a dedicated nurse, earns an annual salary of €50,000. Unfortunately, she suffers a serious back injury while on duty, rendering her unable to work for an extended period. Sarah is entitled to €11,440 per annum of state illness benefit. Fortunately, Sarah had the foresight to invest in income protection coverage. With 75% of her salary minus state benefits protected, she receives a monthly benefit of €2,171.67. (75% of €50,000=€37,500-€11,440= €26,060 per year or €2,171.67 per month.

This financial support allows Sarah to cover her living expenses, such as rent, groceries, and other bills, while she focuses on her recovery and rehabilitation. The income protection benefit ensures that Sarah can maintain her financial stability and concentrate on getting back to her passion for nursing.

These examples demonstrate how income protection provides medical professionals with a significant portion of their salary, allowing them to maintain their standard of living and financial security when they are unable to work due to illness or injury.

Is Income Protection Easy to get?

Short answer is not really. Income Protection is the best of the best when is comes to protecting your income as it covers all types off illness, injuries and accidents. As such, you have to be in pretty good health to get income protection and any serious health issues you have experienced in the past will likely be excluded from any future claims on an income protection plan.

So, if you are in perfect health with no serious health history now is the best to get your Income Protection in place.

The Benefits of Income Protection for Medical Professionals

Financial security in the event of illness or injury

Peace of mind knowing that you’ll be able to meet your financial obligations

The ability to maintain your standard of living

Protection for your family

Tax relief on premium payments

What type of income protection plan is the best?

When choosing an income protection policy, it’s important to consider the following factors:

The amount of the benefit

The waiting period- 4,8,13,26 or 52 weeks

The term of the policy- ideally up to retirement age

The premiums- remember tax relief at 40% or 20%

Shop around and compare policies, benefits and costs from different insurers.

Lastly, remember the difference between Guaranteed and Reviewable Income Protection Plans.

With Reviewable Income Protection plans the cost is not fixed and the insurer can increase the cost of your cover in the future. Unlike Guaranteed Income Protection Plans where the cost of cover is fixed and will not change. (Even if you claim)

Conclusion

Income protection is an essential financial safeguard for medical professionals. It can provide peace of mind knowing that you’ll be able to meet your financial obligations if you’re unable to work due to illness or injury.

If you’re a medical professional, I encourage you to consider purchasing an income protection policy.

It’s one of the best ways to protect your financial future.

To get an Income Protection Quotations just click “GET QUOTE”

If you have any questions in relation to this you can reach me personally on 01 582 3523 or email me at Aidan@financiallife.ie

Thanks for reading

Aidan

Keywords: income protection, medical professionals, Ireland, financial security, peace of mind, tax relief

Disclaimer: The information provided in this blog post is for informational purposes only and should not be considered as professional advice. It is advisable to seek expert financial advice for personalized guidance regarding life insurance.

YOU MAY ASO BE INTERESTED IN

The best Income replacement plans in Ireland

Life Insurance Terminology Explained

Can You Get Life Insurance After Cancer ?

Getting Life Insurance with Diabetes

Insurance

Insurance  Insurance

Insurance  Insurance

Insurance  Insurance

Insurance