How to Start a Pension in Ireland: Your Step-by-Step Beginners Guide

I have recently seen one of our pension partners’ advertisings and felt their short one-line promotion was perfect, “Small actions can have great impact”. If you have landed on this page well done, you are taking that small step that will change your financial future for the better.

Pensions get a bad wrap as being boring and uninteresting, however, these tax-efficient saving schemes are one of the best ways to reduce your tax bill and grow your wealth at the same time.

How do you think you will survive on the state pension alone, currently €265.30 per week?

Saving for retirement is one of the most important financial decisions you will ever make. A pension is a long-term savings plan that can help provide a comfortable level of income for yourself in retirement. Starting a pension will provide you with additional income on top of any state pension that is available.

Benefits of Saving into a Pension

Let’s say you are a 40% tax rate payer; you are willing to put €100 invested into a boring pension. How much does that cost?? €100?? Nope.

The actual cost to you is €60, the other €40 is money you would have paid in tax anyway, but instead that €40 goes into a lovely tax-efficient savings plan in your name. Now if someone off the street said to you ” hey Mr and Mrs, for every €60 you give me I will give you back €100″ what would you say? Probably “Speak to me again and I am calling the guards”.

I get that because it would seem like a scam and too good to be true. However, this is how pensions work!!! To incentivize people to save and grow their wealth for retirement, very generous tax reliefs and allowances are available for anyone who wishes to start a pension in Ireland.

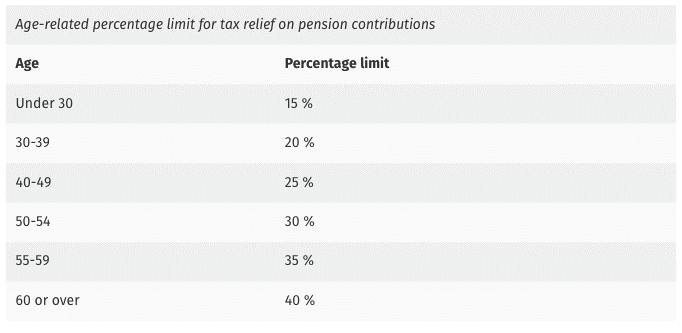

Under Revenue Rules, the % percentage of your salary you can contribute and get tax relief will depend on your current age:

For example, an employee who is aged 30 and earns €50,000 can get tax relief on annual pension contributions up to €10,000 (20% of €50,000).

The maximum amount of earnings taken into account for calculating tax relief is €115,000 per year.

Remember, the Benefits of Saving into a Pension:

1. Tax relief on money you pay in

2. Your investment grows tax-free

3. Tax-free lump sum when you retire

Ok, I Want to Reduce My Tax Bill and Grow My Wealth, How Do I Start a Pension in Ireland?

Step 1: Understand and Select the pension that suits you best.

The type of pension options available to you will depend on whether you are a PAYE Employee, self-employed, or a Company Director.

To give you an idea these are the usual pension options open to each:

PAYE Employee: Personal Pension Plan, Personal Retirement Savings Account(PRSA), or Occupational Pension Scheme via employer( if available)

Self-Employed: Personal Pension Plan or Personal Retirement Savings Account(PRSA)

Company Director: Executive Pension Plan or Personal Retirement Savings Account.

It is really important for me to note, that all of the above pensions have advantages and disadvantages depending on your personal circumstances. I cannot emphasise enough the need to get Expert Pension Advice before you proceed with one particular option.

Step 2: Get Expert Pension Advice

At this point you know you want to start a pension but need to get advice from an expert you can trust to take your plan to the next stage.

It is important to meet with a financial advisor to discuss your specific needs and goals. Each person’s idea of what a good retirement means to them will be different. A good advisor can help you choose the right pension plan for you and develop a savings strategy that meets your budget and risk tolerance.

Step 3: Complete a Fact-Finding Process

I also like to call this the “getting to know you stage”.

During the fact-finding process, your advisor will ask you a series of questions about your financial situation, including your income, expenses, debt, and assets. They will also explore your retirement goals with you and how these goals can be achieved. Like I said before we are all different, some will want to travel the world or buy a boat in retirement, while others will just want a comfortable day-to-day life.

Importantly, there is no wrong answer to these questions, it is about what is right for you.

This information you provide to your financial advisor will help them create a personalized pension plan for you.

Step 4: Tolerance for Risk when It Comes to Investing

Pension plan will usually consist of investing in stocks, bonds, property, and alternatives such as gold and commodities.

Pensions are not cash in the bank so it is important you are invested in a plan that matches your risk profile/personality. However, do not panic as there is an investment option to match no matter your risk tolerance.

The ESMA SCALE

This is the European Securities and Markets Authority system for assessing how risky an investment fund is and it goes from a 1 -7. For example, someone with a risk tolerance of Level 1 on the ESMA scale is considered low risk, someone on this level might be best suited to a 100% cash investment. Someone who is considered Level 7 is considered to have a high-risk tolerance and may be suited to a pension plan 100% invested in stocks.

Your financial advisor will help you select funds that best match your attitude to risk.

Step 5: Choose Investment Option For Your Pension Plan

Your investment choices will depend on your risk tolerance and personal preferences. Some people want to be actively involved in all aspects of their pension, while others prefer a more hands-off approach.

Here are the general investment options:

1. Default Investment Strategy: This is a popular option as it is a hands-off approach. It involves automatic phased switching between investment funds from those with an emphasis on growth in the early years to more secure funds as you approach your planned retirement age, this is known as de-risking and aims to lock in the gains you made in your youngers of higher risk investing.

The Default Investment Strategy aims to:

- Invest during your younger years mainly in higher risk/higher return assets like equities,

- Gradually shifting to a more secure lower risk/return bond/cash dominated mix in the run-up to retirement.

2. Self-select Investing Strategy: This option gives you the most control over your investments. You can choose what you want to invest in and when you want to change any investments. With this option, you should be regularly reviewing your pension with your financial advisor.

Active vs. Passive funds: What’s the difference?? Which should I choose?

This is one of the big debates in the world of investing. Some Investors choose to invest in investments that are actively managed by expert fund managers and their teams, these are known as managed funds. The fund manager’s goal is stock and asset selection with the aim to beat or outperform a particular index over a period of time.

For example, beat the S&P 500 by 4.5% per annum on average. Other investors prefer to invest in an index that is not managed by anyone and this is known as passive investing., e.g. Global Equity index that is not managed and that tracks the performs of the global stock market in general.

Passive funds are simpler and cheaper than active funds. They aim to match the performance of a specific market index, so the fund manager doesn’t need to make any active decisions about which stocks to buy and sell. This results in lower fees for investors.

Active funds have the potential to beat the market, but they are also usually more expensive than passive funds.

Step 6: Probably the Most Important Step, Get Started Now!

Once you have decided on the best pension plan and investment strategy, your advisor will gather and complete the required paperwork with you. This is the easy part on your side as your Advisor will do most of the leg work!!

Review, Review, Review

Remember, your pension plan is a long-term investment, so it’s important to review it regularly to make sure it’s still on track to meet your retirement goals, I would recommend yearly reviews. You may need to adjust your plan as your circumstances change, such as if you get married, have children or start a new job.

When should I start saving for a pension?

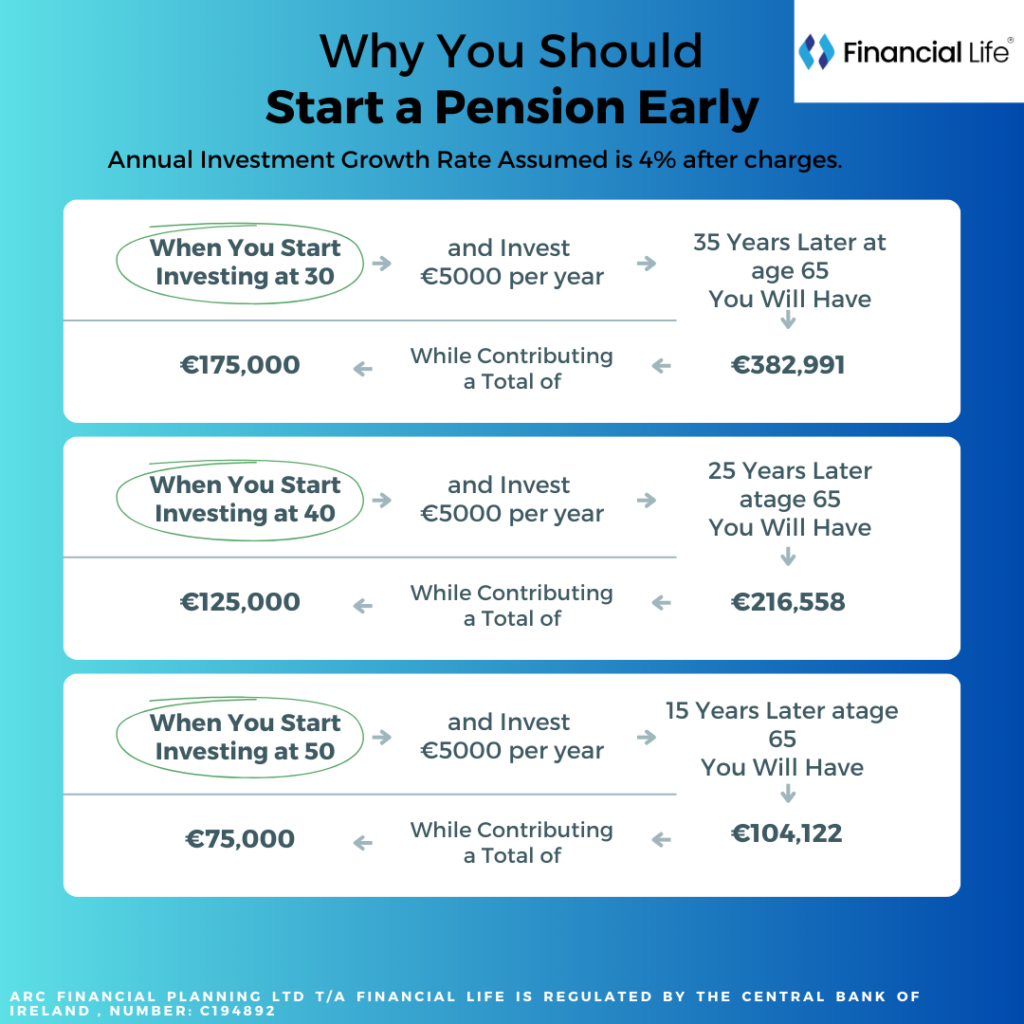

The earlier you start saving for a pension, the better. This is because your money will have more time to grow and compound.

Above are the benefits of compounding. If you are able to start saving for a pension in your 20s or 30s, you will be on your way to achieving a comfortable retirement income.

How much should I put into my pension?

This really depends on your goals and the level of income you feel you will need in retirement. Generally, I would recommend ideally 10-15% of your before-tax income each month. However, in the real world, this may not be possible, especially at the start of your career.

Here are a few tips for saving for a pension:

Start saving as early as possible, this will give your money more time to compound and grow.

If you are in company scheme, max out your employer contributions. (Its free money on the table)

Increase your contributions as your income increases

Review your pension regularly.

Seek expert financial advice. A recent 2021 Value of Advice Research conducted by brokers Ireland found :

“Those who used a financial advisor had an average pension pot of €128,933, over double the amount of those without a financial advisor (€62,600)”.

Ready to start Pension??

Check out our testimonials:

Finally, If you have any questions in relation to this you can reach me personally on 01 582 3523 or email me at Aidan@financiallife.ie

Thanks for reading

Aidan

Disclaimer: The information provided in this blog post is for informational purposes only and should not be considered professional advice. It is advisable to seek expert financial advice for personalized guidance regarding life insurance.

YOU MAY ALSO BE INTERESTED IN

What Should I Do with my Pension as I have left my Job?

Pension Options When Leaving Employment – Video

Mortgage Protection VS Life Insurance – Know the Difference

Why choose Financial Life for expert financial advice?

What is the difference between Mortgage Protection and Life Insurance?

Insurance

Insurance  Insurance

Insurance  Insurance

Insurance  Insurance

Insurance